Table of contents

Alpha and beta are two metrics that constitute the bedrock of modern portfolio theory. For anyone who wants to build a successful portfolio of stocks and hit their investment goals, knowing these terms is an absolute must. They represent active management, and market dynamics to guide you towards the investments you should be making, and the ones you should be avoiding.

In this article, we’re going to understand what is alpha and beta, how they’re calculated, and how you can leverage them to make smarter decisions.

What is beta in the stock market?

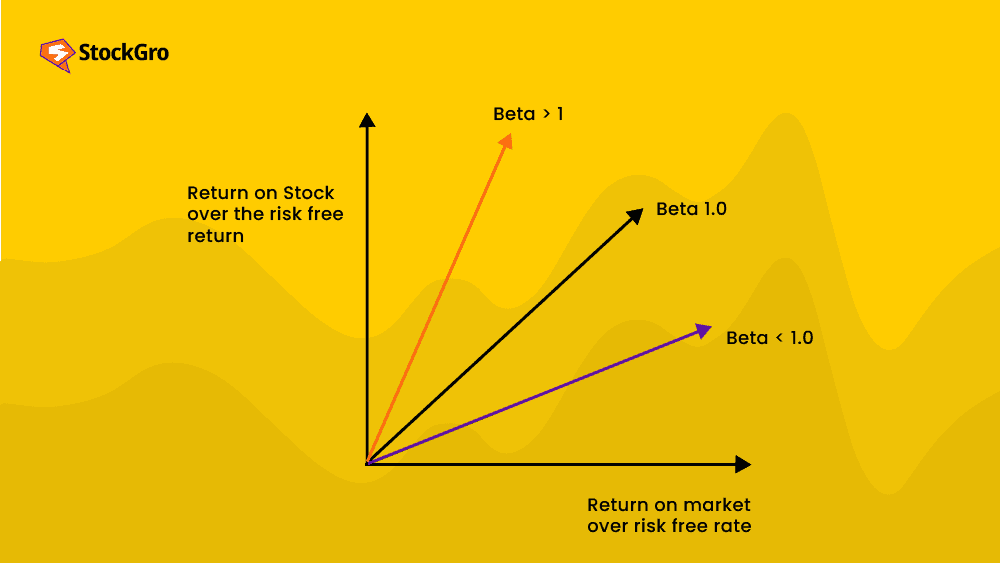

We’re starting with beta because, as a concept, it’s easier to understand than alpha. Beta is a measure of how volatile a particular stock is relative to a benchmark – which is usually an index but could also be another security.

This means that stocks that have a high beta (β>1) are more volatile than the index fund comparable. For instance, if β for a security is 1.5, it means that the stock moves by a factor of 1.5 when the comparable does, in the same direction. In other words, the stock is said to have 50% more risk than the overall market.

When the beta is close to zero, it means that the investment mimics the movement of the compared index. When beta is negative, however, it means that the stock mimics the index but in the opposite direction. Hence, when the index moves, a stock with β = -2 will move in the opposite direction by a factor of two.

How is beta used?

- If your stocks have a beta that’s much higher than indices like NIFTY 50 and SENSEX, it means that you’re taking on a lot of risk with your investments.

- Something close to zero? That means whenever the index becomes more volatile, so does your portfolio.

- If your overall beta is negative, it means that your portfolio will experience negative volatility; when the index goes down, your portfolio goes green.

If you’re willing to take on a lot more risk, consider investing in high-beta stocks since they tend to have better returns in the long term in exchange for greater short-term risk. However, if you’re more conservative, sticking close to the index is a better strategy.

Note: Keep in mind, however, that beta numbers become less effective the older they are. This also means that beta is not good at predicting future returns and measures past performance only.

What is alpha in the stock market?

Alpha is a bit more complicated. It is defined as the excess return on an investment after you’ve adjusted for random fluctuations and market volatility. Alpha is represented by a single number, which indicates the percentage by which your investments outperformed the index or fund you were comparing it to.

It is a historical figure, which means that it can track how your stock or portfolio performed in the past, offering little information about the future.

Alpha = Asset return – Benchmark return

For instance, if your portfolio did 3% better than the SENSEX, your alpha would be +3.

- True alpha

Now, you might have heard mutual fund companies claim to have “high alpha,” implying that they have the skills to beat the index by a lot. But the question arises – which index would you use? When funds invest in small-cap stocks, which have higher risk and higher returns, is NIFTY the right index to use?

In this case, a small-cap index fund is a much more accurate option. While NIFTY’s yearly 10% returns might inflate the fund’s alpha to 3 or even 4, a small cap index might bring it down to 0 or 1. Very few investors have true alpha when market volatility is taken into account. This is also true because it takes more than 10 years to know for sure whether they do.

Conclusion

As we noted with both of these metrics, they’re not one-size-fits-all indicators. No indicator is. They have to be used in conjunction with other technical and fundamental indicators to establish confidence in the investment decision.

What’s more, they’re only historical metrics, meaning that they have no say over what the future holds.

When analysing your portfolio with alpha and beta in the stock market, it is helpful to know what your investment goals and objectives are, along with your risk appetite. This will let you adequately measure your target beta for your overall portfolio, and calculate your potential alpha in the short-term.

FAQs

To find the alpha and beta of stocks, investors typically use regression analysis against a market index. In India, investors might compare against the BSE Sensex or NSE Nifty. Alpha is calculated by subtracting the risk-free rate from the stock’s return and then subtracting the product of the stock’s beta and the market’s excess return from this value. Beta is calculated by dividing the covariance of the stock’s return with the market return by the variance of the market’s return.

When alpha increases, it signifies that a stock or portfolio is outperforming the benchmark index. This excess return could result from skilled management, unique strategies, or favourable market conditions. Investors often view rising alpha positively, as it indicates added value beyond market expectations. However, it’s essential to consider other factors, such as risk management and the consistency of performance, to ensure sustained success. High alpha can be beneficial, but due diligence remains crucial for long-term investment decisions.

A high alpha is generally desirable for investors. It implies that the investment has delivered superior returns compared to the market. However, investors should assess other factors, such as risk exposure and the reliability of alpha over time. Sustained high alpha is more valuable than occasional spikes. Additionally, understanding the underlying reasons for alpha (such as stock selection, timing, or sector allocation) helps investors make informed decisions. In summary, high alpha is good, but prudent evaluation is essential for effective portfolio management.

A good stock beta depends on the investor’s risk tolerance and investment strategy. A beta of 1 implies that the stock’s price moves with the market. A beta less than 1 suggests that the stock is less volatile than the market, which may be preferred by risk-averse investors. A beta greater than 1 indicates higher volatility, which might be suitable for investors seeking higher returns and willing to accept more risk.

A beta of 0.8 means that the stock is less volatile than the market. It suggests that the stock’s price is expected to move 80% as much as the overall market. If the market goes up by 10%, a stock with a beta of 0.8 might go up by 8%. This lower volatility can be appealing to conservative investors who prefer stability over higher risk.