Table of contents

Curious about what’s really happening behind corporate takeovers? Welcome to Schedule TO-T, your exclusive access to the behind-the-scenes world of tender offers. This required SEC form reveals the complex interaction between acquiring entities and their targets. It’s not just paperwork; it’s the exciting plot of an acquisition story.

With insights into pricing strategies and acquisition tactics, Schedule TO-T provides valuable information, promoting openness in the competitive realm of business manoeuvres.

Prepare yourself to unravel the mysteries hidden within the inner workings of corporate takeovers – Schedule TO-T.

Tender offers and takeover bids

Tender offers play a crucial role in public takeover bids, allowing investors or companies to acquire shares directly from existing shareholders, often bypassing the management of the target company. This approach enables the acquiring company to gradually accumulate a substantial ownership position, with the ultimate goal of obtaining control over the target firm.

What is schedule TO-T?

Schedule TO-T is a vital document required by the Securities and Exchange Commission (SEC). When one entity starts a tender offer for the equity securities of another, this is an essential step. The form must be filed with the SEC if the entity plans to acquire more than 5% stake in another company.

Let’s break it down:

- Tender offer (TO): This refers to an invitation by an external entity to purchase shares from existing shareholders. Often, this happens as part of an acquisition strategy.

- Third-party (T): The offer doesn’t come from the target company itself but from an external party.

The form ensures transparency and regulatory compliance by disclosing vital details about the tender offer. It helps shareholders and market regulators make informed decisions.

Purpose and contents

Purpose of Schedule TO-T

- Disclosure: Schedule TO-T is designed to provide all the necessary details regarding a tender offer. It guarantees transparency and offers shareholders crucial information.

- Terms and conditions: This document summarises the tender offer’s terms and conditions. This provides detailed information regarding pricing, acceptance procedures, and other pertinent aspects.

- Informed decision-making: Through the provision of detailed information, Schedule TO-T empowers shareholders to make well-informed decisions about their involvement in the offer.

Contents of Schedule TO-T

- The entity presenting the tender offer bid: Identifies the party initiating the offer.

- The subject company: Specifies the company whose shares are being targeted for acquisition.

- CUSIP number of the securities: Unique identifier for the securities being tendered.

- Number of shares: Total quantity of shares subject to the tender offer.

- Price per share: The price that has been offered for each share in the tender offer.

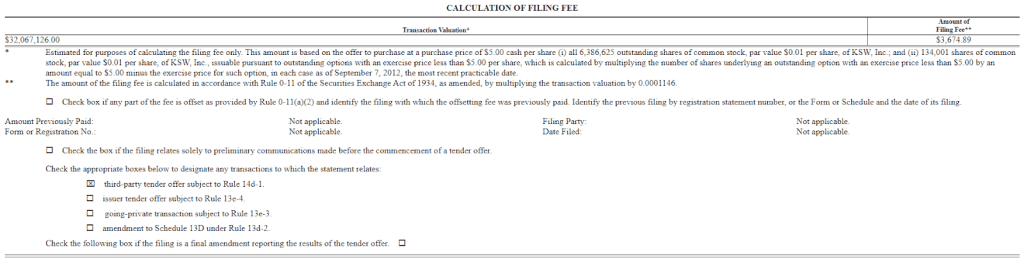

- Transaction valuation: Total value of the transaction based on the offered price and the number of shares tendered.

- Filing fee calculation method: Explanation of how the filing fee is calculated for the tender offer.

- Amendments to the initial tender offer statement: Any changes or updates made to the initial tender offer statement previously filed with the SEC.

Other SEC forms in tender offers

Schedule TO-I

This form provides details about the issuer. It offers information on the company initiating the tender offer, including its background, financials, and intentions. Investors and regulators rely on Schedule TO-I to evaluate the trustworthiness and validity of the offer.

Schedule TO-C

Documented whenever any written correspondence relating to the tender offer is prepared and circulated. With the disclosure of all materials shared with shareholders during the offer process, transparency is assured.

Schedule TO-T history

Sections 14d and 13e of the Securities Exchange Act of 1934 provide the basis for the reporting of a tender offer. The purpose of this law is to regulate the secondary market for securities. Its objectives involve improving market accuracy, and transparency, and preventing financial fraud.

In January 2000, the Schedule TO-T form replaced the earlier Schedule 14D-1. According to Regulation 14d, it is necessary to send a fully filled-out Schedule TO-T (also referred to as the third-party tender offer statement) not only to the SEC but also to designated parties.

These recipients consist of the security’s issuer as well as any other organisations that have made rival bids for the target business. The regulation sets forth additional requirements that must be adhered to during a tender offer process.

Bottomline

Schedule TO-T is a crucial tool in the realm of corporate takeovers, providing insight into the complex world of tender offers. To ensure that shareholders and market regulators have access to crucial information about tender offers, this form provides essential transparency and regulatory compliance, as mandated by the Securities and Exchange Commission.

By thoroughly examining the information presented in this form, investors acquire a crucial understanding of the tender offer’s purpose, specific terms, and associated conditions. Investors can make an informed decision about the offer, selling their shares, or keeping their investments with this knowledge.

FAQs

If you choose not to sell your shares during a tender offer, several outcomes may occur. First, if the offer is successful and the acquiring company obtains a majority stake, your shares may become minority holdings. Second, you’ll retain ownership but may face reduced liquidity if other shareholders sell. Lastly, your voting power could diminish if the acquirer gains control.

A Rule 13E-3 transaction is defined under the Securities Exchange Act of 1934. It typically involves a merger, acquisition, or recapitalisation where controlling or affiliated shareholders reduce the number of shareholders in the target company. As a result, the target may no longer need to maintain reporting obligations with the SEC for a specific class of shares or may become eligible for delisting. Rule 13E-3 mandates filing a Schedule 13E-3, providing detailed disclosures about the transaction’s implications for shareholders.

A tender offer can be both advantageous and risky, depending on the context. Here’s a succinct breakdown:

Advantages:

Liquidity: Shareholders can sell their holdings quickly.

Premium: Tender offers often come with a premium over the market price.

Exit Strategy: It provides an exit route for investors.

Risks:

Coercion: Minority shareholders may feel pressured to sell.

Loss of Control: Selling shares reduces ownership and voting power.

Failed Offers: Tender offers can fail due to various reasons.

Evaluate tender offers based on your investment goals, company specifics, and market conditions.

A 20-day tender offer refers to a structured liquidity event in which a buyer or group of investors offers to purchase a specified quantity of shares from existing shareholders at a predetermined price. Under U.S. Securities and Exchange Commission (SEC) rules, tender offers must remain open for at least 20 business days. During this period, shareholders can evaluate the offer, seek advice, and decide whether to participate. It provides an avenue for shareholders to monetise their equity while the company remains private.

A Dutch auction (also known as a descending price auction) is a unique type of auction where the auctioneer starts with a very high price and gradually lowers it until a bidder places an offer. The first bid that meets or exceeds the reserve price wins the auction, avoiding competitive bidding wars. In financial markets, Dutch auctions occur when investors bid for securities, specifying both the quantity and price they are willing to buy. The final offering price is determined based on all bids received, ensuring the entire offering is sold at a single price.