Step Up SIP Calculator

Growing your wealth doesn't have to mean making a big leap all at once. You can start with smaller monthly contributions and increase them each year. This approach is called step up SIP where you match your investments with your income's natural growth.

Unlike standard SIPs that keep monthly contributions fixed, step-up SIPs let you gradually increase your investment each year, keeping pace with any rise in income. This method not only boosts your returns but also makes investing feel more manageable.

Imagine starting small, then adding a little more as your finances grow. A SIP calculator with Step Up helps you see how these steady, annual increases can amplify your investment over time. It's a practical choice for those who want their investments to grow alongside their income - ideal for salaried individuals or anyone seeking a gradual yet powerful way to build wealth. Let's explore how you can use the Step Up SIP calculator for your benefit.

What is the Step Up SIP Calculator?

The Step SIP calculator is a specialised financial tool designed to compute returns from systematic investments that increase yearly. This calculator helps investors estimate potential returns from their Step-Up SIP investments across their chosen timeframe.

The calculator processes complex calculations automatically, considering both the power of compound interest and the impact of annual investment increases. This combination creates a powerful tool for long-term wealth creation through systematic investing.

To begin calculations, you need these essential details:

- Monthly Investment Amount: Your starting monthly contribution

- Investment Period: Duration of your investment plan in years

- Expected Rate of Return: Anticipated annual returns from chosen funds

- Annual Step-Up Percentage: Yearly increase in monthly investment

Once these details are entered, the Step Up SIP calculator formula processes them to show how investments could grow with annual increments. The calculations factor in both the compounding effect on existing investments and the impact of increased monthly contributions.

How Does the Step Up SIP Calculator Work?

The Step Up SIP Calculator calculates the maturity amount by using a compound interest formula, with an additional factor to account for yearly increases in monthly contributions.

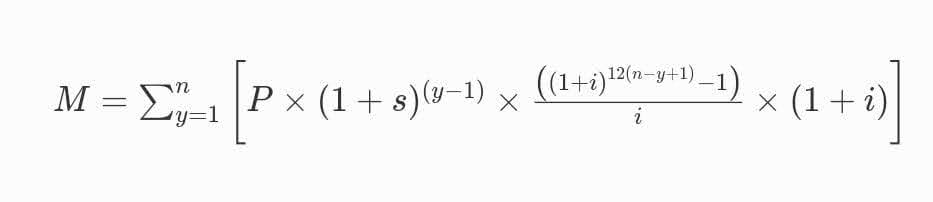

Here's a Step Up SIP calculator formula:

Where:

- M: Final maturity amount

- P: Initial monthly investment amount

- i: Monthly rate of return (Annual rate/12)

- n: Investment duration in years

- s: Annual step-up rate (as decimal)

- y: Year number

The step-up SIP approach adjusts the monthly investment amount each year by a specified percentage, making it easier to increase your contributions over time. Here's how this works in practice:

Example:

Suppose you start with a monthly investment of ₹10,000 and increase it by 10% each year. Here's how it would look:

| Year | Monthly Investment (₹) | Annual Increase (%) | Annual Investment (₹) |

|---|---|---|---|

| Year 1 | 10,000 | - | 1,20,000 |

| Year 2 | 11,000 | 10% | 1,32,000 |

| Year 3 | 12,100 | 10% | 1,45,200 |

By factoring in these increases, the Step Up SIP Calculator projects the potential growth of your investment, allowing you to see the benefits of incremental contributions. This can help you make well-informed decisions and stay on track to reach your financial goals.

Benefits of Step Up SIP Calculator

The calculator provides multiple advantages for investment planning, from basic calculations to comprehensive financial projections.

1. Inflation Management

By showing projections with increasing investments, the calculator helps plan for rising costs. Annual step-ups ensure investments grow proportionally with inflation, maintaining purchasing power over time. This feature is particularly valuable in long-term financial planning.

2. Goal-Based Planning

The calculator helps investors align their increasing investments with specific financial goals. By projecting future corpus values based on stepped-up investments, it provides clear targets and milestones for wealth creation.

3. Risk Assessment

Regular investment increases help manage market volatility through rupee cost averaging. The calculator shows how systematic increases can optimise returns across market cycles.

4. Financial Discipline

The step-up feature promotes disciplined investing by automating annual increases. This helps investors maintain investment momentum and avoid the impact of inflation on their savings.

Steps to use Step Up SIP Calculator

A SIP calculator with Step Up is a valuable tool for investors who want to gradually increase their monthly contributions over time, aligning their investments with their growing income. Let's walk through the simple steps to use this calculator effectively:

- Go to the StockGro Step Up SIP calculator.

- Enter your initial monthly investment amount in the space provided.

- Input the expected rate of return, which represents the annual percentage yield you hope to earn on your investment.

- Specify the investment tenure. This is the total period for which you plan to continue the SIP.

- Add the annual step-up percentage. This is the rate by which you plan to increase your monthly investment each year (e.g., 10%).

Once you've entered these details, the calculator will automatically compute the projected maturity amount, estimated returns, and the total invested amount.

Get ahead with StockGro Step Up SIP Calculator

The Step SIP Calculator transforms investment planning by automatically factoring in annual increases. This systematic approach helps maintain investment momentum while accounting for rising income levels. By providing clear projections and easy calculations, it enables informed investment decisions.